Crypto Market Downturn, Most Comprehensive 2025 Stablecoin Investment Strategy Takes You Through Bull and Bear Markets

Original Author: @arndxt_xo, Crypto Researcher

Original Translation: zhouzhou, BlockBeats

Editor's Note: This article discusses the strategies and returns of several interest-bearing stablecoins, including how different platforms generate returns through investing in U.S. Treasuries, DeFi lending, and real-world assets. Each stablecoin has different strategies and yields, such as earning returns through staking, lending, or liquidity mining. The article also mentions the characteristics of these stablecoins, such as no lockups, automatic compounding returns, suitable for long-term investment, and users who require stability, providing an innovative decentralized finance solution.

The following is the original content (slightly rephrased for better readability):

What is an interest-bearing stablecoin? It is a stablecoin pegged to 1 USD that also generates passive income. How is this achieved? Through lending, staking, or investing in real-world assets like U.S. Treasuries. You can think of it as an on-chain money market fund, but it is programmable and borderless.

In a stablecoin market exceeding 225 billion USD with annual transaction volumes in the trillions, interest-bearing stablecoins are emerging as:

• On-chain savings accounts

• Yield-bearing products backed by RWAs

• Alternatives to banks and fintech

• Maintaining assets in USD while offering annual yields of around 3–15%

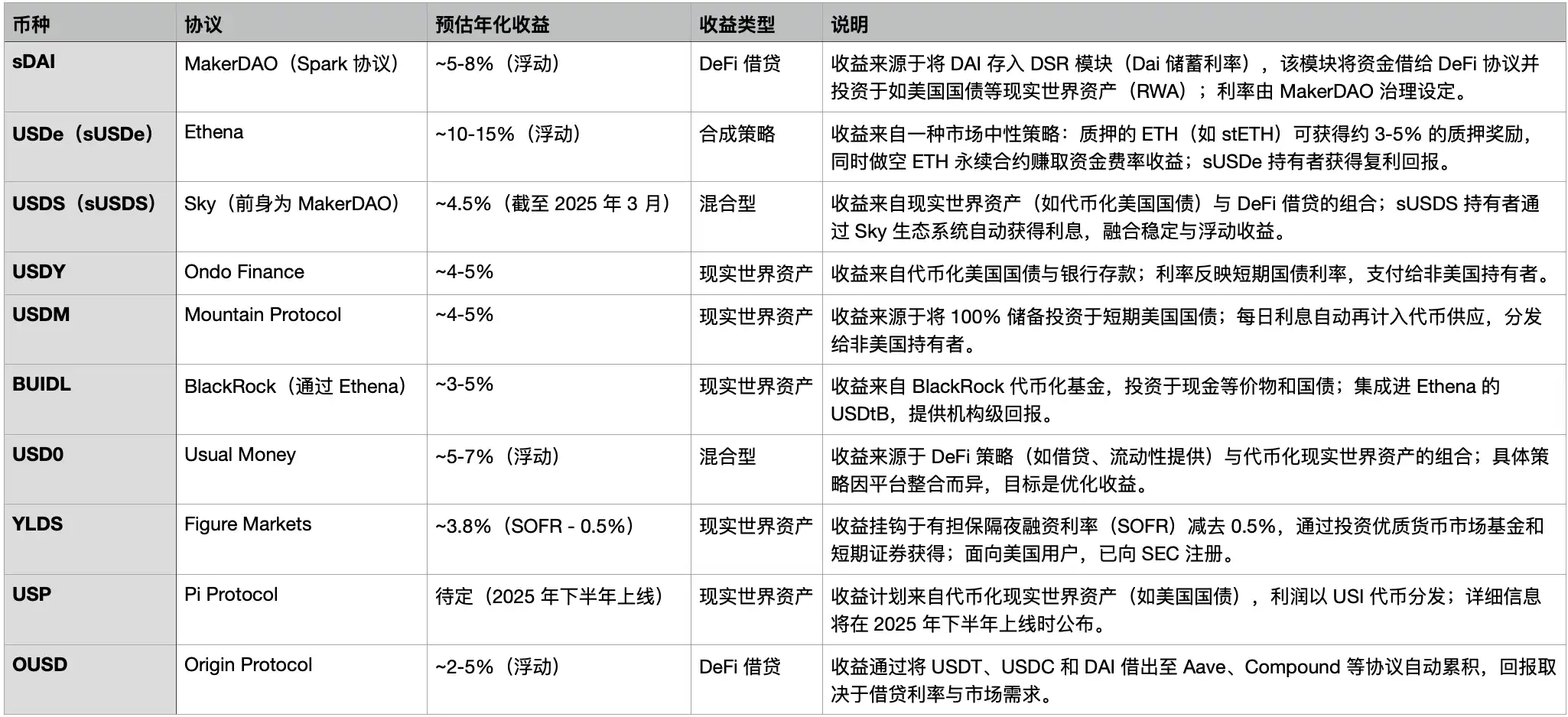

Next, let's break down how mainstream protocols achieve these returns

sDAI – Provided by MakerDAO via @sparkdotfi

→ Annual Percentage Yield: Around 5–8% (variable)

→ Strategy: DSR (Dai Savings Rate) returns from various sources

• Deposit DAI into Spark

• Sources of returns include:

• Stability fees from loans

• Liquidation proceeds

• DeFi lending (e.g., Aave)

• Tokenized Asset of US Treasury Bonds

You will receive sDAI, a token based on the ERC-4626 standard, with an automatically increasing value (non-rebasing), and the yield is adjusted by the governance mechanism based on market conditions.

sUSDe – Synthetic Yield provided by @Ethena_Labs

→ Annual Yield: About 8–15% (up to 29% at peak in a bull market)

→ Strategy: Delta-neutral yield from Ethereum

• Deposit ETH → Stake via Lido

• Simultaneously short ETH on CEXs

• Financing Rate + Staking Reward = Yield

sUSDe holders will receive compound interest. High yield = High risk, but not reliant on banks at all.

sUSDS – Provided by @SkyEcosystem (formerly MakerDAO team)

→ Annual Yield: About 4.5%

→ Strategy: Hybrid RWA + DeFi Lending

• Base Yield from Tokenized US Treasury Bonds

• Additional Yield from Spark Lending

• Yield distributed through Sky Savings Rate (SSR)

No collateral, no lock-up, automatic balance accumulation, governance mechanism sets the target annual yield for SSR.

USDY – Provided by @OndoFinance

→ Annual Yield: About 4–5%

→ Strategy: Tokenized Traditional Finance for non-US holders

• 1:1 Backed by Short-Term US Treasury Bills + Bank Deposits

• Earn Yield Similar to a Money Market Fund

• Due to Reg S, Yield Distributed to Non-US Users

Likely auto-compounded, making passive income even more seamless.

USDM – Provided by @MountainPrtcl

→ Annual Percentage Yield: Around 4–5%

→ Strategy: 100% Backed by US Treasury Bills (T-Bill)

• All Reserves Comprised of Short-Term US Treasury Bills

• Daily Rebasement for Balance Growth (e.g., Daily Growth of 0.0137%)

• Only available to non-US holders

Simple, stable, and fully transparent through audits.

USDtb – Provided by @Ethena_Labs and @BlackRock

→ Annual Percentage Yield: Around 3–5%

→ Strategy: Institution-Grade Tokenized Fund

• BUIDL is a tokenized fund composed of US Treasury Bills, cash, and repurchase agreements (repos)

• USDtb uses BUIDL to back 90% of reserves

• Combines traditional financial security with 24/7 DeFi availability

Highly suitable for DAOs and protocols seeking security and yield.

USD0 – Provided by @UsualMoney

→ Annual Yield: About 5–7%

→ Strategy: RWA+ DeFi + Staking Rewards

• Base Yield: 3–5% from US Treasury Bonds

• Additional Yield: 1–3% from DeFi Lending and Liquidity Mining

• Staking USD0++ → Receive USUAL Token (up to 60% APY)

Highly composable, deployed on 27 chains and 30+ decentralized applications.

YLDS – Provided by @FigureMarkets

→ Annual Yield: About 3.8%

→ Strategy: Linked to SOFR (Secured Overnight Financing Rate), Yield compliant with SEC regulations

• Anchored to SOFR - 0.5%

• Reserve funds held in Prime Money Market Funds (MMFs) and US Treasury Bonds

• Daily compounding, monthly yield payouts

• Registered Public Securities—Available for US investors to purchase

Stable, regulated, very suitable for compliant on-chain investments.

USP – Provided by @Pi_Protocol_ (Expected to launch in the second half of 2025)

→ Annual Yield: About 4–5% (Projected)

→ Strategy: Tokenization of US Treasury Bonds, Money Market Funds (MMFs), Insurance

• Overcollateralized RWA support

• Dual Token Model:

• USP (Stablecoin)

• USI (Yield)

• USPi NFTs offer revenue sharing + governance rights

Designed to align user interest with platform long-term growth.

OUSD – Provided by @OriginProtocol

→ Annual Percentage Yield: Approximately 4–7%

→ Strategy: DeFi-native, auto-compounding yield

• Lend USDT, USDC, DAI to Aave, Compound, Morpho

• Provide liquidity on Curve + Convex

• Daily auto-compounding to increase wallet balance

No staking, no lock-ups.

You may also like

Ripple Joins Elite Crypto and Banking Players at High-Stakes White House Summit

Key Takeaways Ripple secured a critical position at a White House summit focusing on stablecoin regulation. The meeting…

Crypto Apocalypse Coming: Renowned Expert Foresees Catastrophic End for Cryptocurrency

Key Takeaways Nouriel Roubini, known as “Dr. Doom,” anticipates a “catastrophic end” for the cryptocurrency sector. Even with…

Moonbirds NFTs Are Soaring Again: Unveiling the Recent Price Surge

Key Takeaways Moonbirds NFTs, once a joke in the NFT world, are making a staggering comeback thanks to…

Trump Says Crypto Reserve Will Include XRP, Solana, Cardano—And ‘Obviously’ Bitcoin and Ethereum

Key Takeaways President Trump announced a strategic U.S. crypto reserve to include digital assets such as XRP, Solana,…

‘Big Short’ Investor Burry: Bitcoin Has Not Succeeded as a Safe Haven

Key Takeaways Michael Burry warns that Bitcoin has not proven to be the secure asset many expected it…

SEC Chair Paul Atkins to Make History as First Sitting Chair to Speak at the Bitcoin Conference in Las Vegas

Key Takeaways Paul Atkins, SEC Chairman, is set to become the first sitting SEC Chair to speak at…

Vitalik’s Vision: Redefining Ethereum’s Layer 2 Landscape

Key Takeaways Ethereum creator Vitalik Buterin calls for a new role for Ethereum’s Layer 2 solutions (L2s) as…

Jeffrey Epstein’s Investment in Blockstream and the Unfolding Controversy

Key Takeaways Jeffrey Epstein was involved as an investor in the early seed round of the Bitcoin technology…

Cardano (ADA) Price Analysis for February 3: Can It Stabilize Above $0.30?

Key Takeaways: The current trading value of Cardano (ADA) is $0.2999, reflecting a 1% drop over the past…

SHIB Price Analysis for February 3: A Week to Watch for Shiba Inu Investors

Key Takeaways The SHIB price is currently rising after finding local support at $0.00000677. A potential upward move…

Crypto Market Review: Shiba Inu’s (SHIB) 1,000,000,000,000 Bull Market Trigger, Bitcoin (BTC) Crash Might Stop Here, Is Dogecoin (DOGE) in Mini-Bull Market?

Key Takeaways Shiba Inu (SHIB) shows signs of a potential recovery with a significant green candle, hinting at…

The Top Airdrop Opportunities of January 2026

Key Takeaways: Discover the top five airdrop opportunities available in January 2026, each representing promising tokenless protocols. Uniswap…

BitMine’s $6 Billion Ethereum Losses: Strategic Planning or Market Gaffe?

Key Takeaways BitMine Immersion Technologies, holding the largest Ethereum treasury, reports over $6 billion in unrealized losses. The…

Strategy Stock ($MSTR) Reaches 52-Week Low As Bitcoin Slips Below $84,000

Key Takeaways Strategy ($MSTR) shares hit a session low of $140.25, dropping significantly amid Bitcoin’s price decline. Bitcoin…

Jeffrey Epstein’s Unusual Bitcoin Connections

Key Takeaways: Jeffrey Epstein’s substantial involvement in the cryptocurrency industry, particularly Bitcoin, was revealed through document releases. Epstein…

Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

Key Takeaways Cardano’s current price stability reflects structural balance in the market, maintaining a firm foothold below $0.30.…

Ondo Price Prediction Amid MetaMask’s Integration of Over 200 Tokenized U.S. Stocks

Key Takeaways Ondo (ONDO) token exhibits positive movement, rebounding from a bearish trend and maintaining levels above $0.27.…

Why Bitcoin’s Defense of $76,000 Matters for MicroStrategy’s Earnings Narrative

Key Takeaways MicroStrategy’s Q4 2025 earnings are heavily influenced by Bitcoin’s price performance, especially maintaining the $76,000 level.…

Ripple Joins Elite Crypto and Banking Players at High-Stakes White House Summit

Key Takeaways Ripple secured a critical position at a White House summit focusing on stablecoin regulation. The meeting…

Crypto Apocalypse Coming: Renowned Expert Foresees Catastrophic End for Cryptocurrency

Key Takeaways Nouriel Roubini, known as “Dr. Doom,” anticipates a “catastrophic end” for the cryptocurrency sector. Even with…

Moonbirds NFTs Are Soaring Again: Unveiling the Recent Price Surge

Key Takeaways Moonbirds NFTs, once a joke in the NFT world, are making a staggering comeback thanks to…

Trump Says Crypto Reserve Will Include XRP, Solana, Cardano—And ‘Obviously’ Bitcoin and Ethereum

Key Takeaways President Trump announced a strategic U.S. crypto reserve to include digital assets such as XRP, Solana,…

‘Big Short’ Investor Burry: Bitcoin Has Not Succeeded as a Safe Haven

Key Takeaways Michael Burry warns that Bitcoin has not proven to be the secure asset many expected it…

SEC Chair Paul Atkins to Make History as First Sitting Chair to Speak at the Bitcoin Conference in Las Vegas

Key Takeaways Paul Atkins, SEC Chairman, is set to become the first sitting SEC Chair to speak at…

Earn

Earn